4 Ways Businesses in the Finance Industry Are Getting Paid Faster via Texting

As a business, you want to get paid... not played.

In the financial sector, fees are based on flat fees, percentages of transactions, or some hybrid of the two. But however you’re paid, it’s vital that incoming revenue arrives in a timely manner.

After all, you have your own expenses to pay, and streamlining payments should always be top of mind — whether you’re helping clients execute transactions, providing specialized services, negotiating deals, or offering insurances.

SMS text messages grab a client’s attention like no other marketing channel around. Just as text blasts help nurture client relationships, they can be used to facilitate payment. How? Because texting relays a sense of urgency, delivering powerful Call to Actions and simplifying the process with simple, clickable links that easily direct users to web portals to type in their payment info.

Forget sending out costly mailings or calling clients to remind them bills are past due. Emails are also notably inefficient when it comes to open rates and follow-through. The unnecessary demands on your time can be costly.

You don’t need an excel spreadsheet to see the value behind texting: with 98% open rates, 90% of texts are read within the first three minutes of receipt. Clients are much more likely to pay you on time when prompted with a text notification.

Spend less time worrying about your business and more time running it with texting.

of text blasts are opened and read

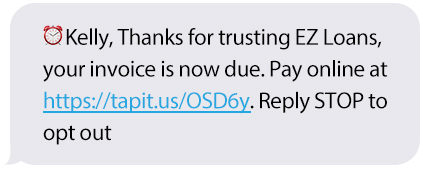

1. Notify Clients with Invoice Text Messages or Outstanding Payment Reminders via Channels They’re Less Likely to Ignore

Perhaps your clients are too busy counting all the extra money you’ve saved them by securing the best loan or insurance for their needs. Or maybe they’re too caught up juggling heavy workloads while simultaneously taking care of the kids during the pandemic. Whatever the reason, your clients are running busy lives, navigating busy schedules, and may overlook payment reminders that come from less effective marketing channels.

This is why it is so critical to be able to send them reminders they will actually notice. Texting cuts through the noise — because text blasts are opened and read at almost 138% more than the rate of emails (98% vs 18%). It’s a staggering figure, but it also makes sense. People are inundated with tsunamis of emails every day; many of us receive hundreds that we just delete without ever looking at them. In contrast, text messages — which are always short and to the point — are less frequently sent. Text subscribers also tend to be much more selective about the companies they opt in for... and so a text naturally commands more attention than an email.

Phone calls can also be easily ignored and sent to voicemail (which may then never be opened). And direct mail can get lost, arrive late, or get tossed on the counter where it will never be seen again.

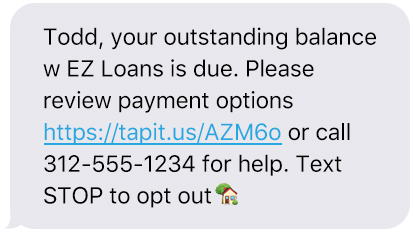

Instead, make a statement that gets heard clearly with SMS text messaging. To generate even more attention and notice, add an emoji for extra impact.

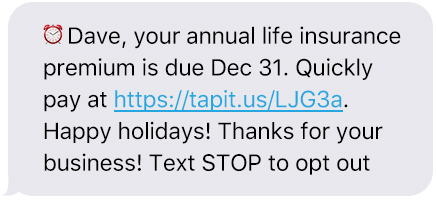

2. Keep Insured Clients on Track with their Premium Due Dates — and Keep Collecting Commissions

If you want to keep those commission checks coming (and of course you do), you need to help clients stay on top of their payment schedules as best you can. After all, if the policyholder stops payment and allows a policy to lapse, everyone misses out. The client loses their coverage, you lose your annual commission, and you may even lose the client entirely

Additionally, if the coverage lapses early on, you may also have to pay back a high percentage of the commission to the insurer.

For example, while commissions vary by policy type and company, life insurance agents often receive up to 80%-100% of the first year’s policy as commission, per Nerd Wallet. Glen Daily, a fee-only insurance advisor in New York City explains, “most of the time companies are in the hole in the first year.” Why? Because if the insured fails to pay their premiums in the initial year or two, agents may have to refund up to 100% of the commission back.

Even if the client’s been with a particular insurance for several years now, the annual commission checks will stop coming if the insured stops paying for their plan.

So it is very much in an agent’s vested interest to help facilitate payment. Texting makes it easy. Gently prompt customers to square off their account by sending a helpful notification when payments come due. Include a link directly to the payment site to simply the process. Automated text messages are simply the most efficient channel for this… in contrast, a phone call may feel disruptive and emails can feel spammy.

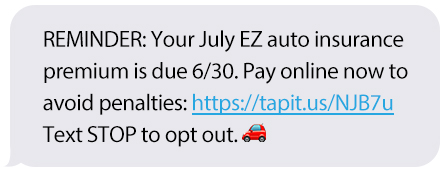

3. Send Automated Text Reminders with a Trackable Link to Remit Payment

Keeping business booming can be as easy as sending out a few timely reminders. In the same way you communicate important notifications to protect the financial security of your clients (ie alerting them to low balances or updates on loan authorizations), you can leverage texting to facilitate billing concerns and ensure your own economic stability.

Send automatized reminder texts to clients on invoices with trackable links that they can easily click to ensure their account is paid in full. Texting makes payment a breeze in just a few clicks.

4. Reduce Time Spent By Accounting Staff on Tedious Follow-Up Calls

No need to waste energy by calling up your roster of clients to hound them for payment. It’s an unnecessary hassle and simply not the best use of time. Let texting do the hard work for you.

Send automated text reminders that will streamline the payment process with just a few clicks… and turn your focus onto other business at hand.

See other resources related to: